5 Most Affordable States for Retirees

Learn what the most common factors for an affordable retirement are, which states in America meet that criteria best, and the positives and downsides to retiring in them.

Retirement marks a significant transition in life, because it offers individuals the opportunity to enjoy a newfound freedom, pursue hobbies and spend time with loved ones. For many retirees, financial considerations play a crucial role in determining their quality of life during their golden years.

Choosing to retire in a state with a lower cost of living can help stretch retirement savings further and ensure a comfortable lifestyle. On the other hand, retiring in a state with a higher cost of living and hefty taxes can quickly lower the value of the retiree’s saved money. Discover the most affordable states for retired seniors and gain insight on factors such as housing costs, healthcare expenses, taxes, and overall affordability.

Key Takeaways

Understanding Affordability Factors

Before identifying the most affordable states for retired seniors, it's essential to understand the main factors that contribute to affordability:

Cost of Housing:

Housing costs, including rent or mortgage payments, property taxes, and homeowners insurance, are significant expenses for retirees. Affordable housing options can significantly impact the overall cost of living in a particular state. If a large portion of your income is tied up in your home, there could be less to put away for retirement.

Healthcare Expenses:

Access to affordable healthcare services and insurance coverage is crucial for retirees, especially as they age and may require more frequent medical care. States with lower healthcare costs and insurance premiums can offer significant savings for retirees. It’s also important be aware that Medicare typically only covers about two-thirds of healthcare expenses and the individual will be responsible for the remaining cost.

Taxes:

State taxes, such as income taxes, property taxes, sales taxes, and estate taxes, can vary widely from state to state. Retirees may benefit from choosing a state with favorable tax policies that minimize their tax burden and allow them to keep more of their retirement income.

Cost of Living Index:

The cost of living index compares the relative affordability of goods and services in different states, taking into account factors such as housing, transportation, healthcare, groceries, and utilities. States with a lower cost of living index generally offer a more affordable lifestyle for retirees.

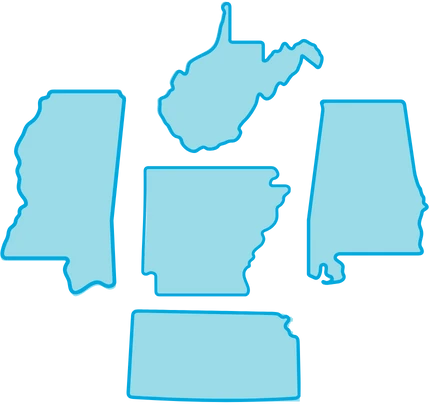

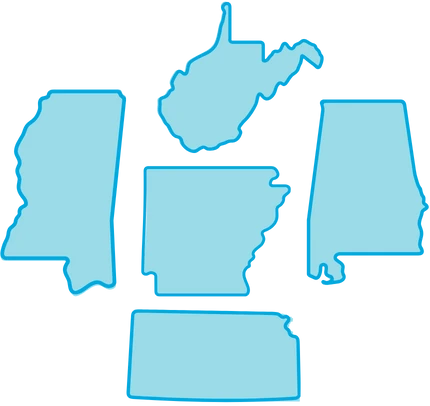

Top 5 Most Affordable States

Mississippi:

Mississippi offers low housing costs, with median home prices well below the national average. Additionally, Social Security benefits are not taxable, and the state provides generous exemptions for retirement income, making it an attractive destination for retirees on a budget.

Arkansas:

Arkansas boasts a low median home price and property tax rate, making it an affordable place to purchase a home or retire on a fixed income. The state also excludes Social Security benefits from being taxed and offers tax breaks for retirement income, further stretching retirees' budgets.

Louisiana:

In Louisiana, the state's median home price is below the national average, making homeownership more accessible for retirees. Louisiana also does not tax Social Security benefits and provides tax exemptions for retirement income, helping retirees keep more of their savings.

Alabama:

Alabama offers affordable housing options, with median home prices well below the national average. Social Security benefits are exempt from state taxation and the state provides tax breaks for retirement income, allowing retirees to stretch their savings further.

West Virginia:

West Virginia rounds out the list of the most affordable states for retired seniors, with a median home price below the national average. West Virginia does not tax Social Security benefits and provides some tax exemptions for retirement income.

Choosing where to retire is a significant decision that can impact an individual's financial security and quality of life. Our list of most affordable states for retirement offers a combination of low cost of living, affordable housing options, and tax-friendly policies for retired seniors. These three factors allow retirees to stretch their savings further and enjoy a comfortable lifestyle without breaking the bank.

Top 5 Most Affordable States

Mississippi:

Mississippi offers low housing costs, with median home prices well below the national average. Additionally, Social Security benefits are not taxable, and the state provides generous exemptions for retirement income, making it an attractive destination for retirees on a budget.

Arkansas:

Arkansas boasts a low median home price and property tax rate, making it an affordable place to purchase a home or retire on a fixed income. The state also excludes Social Security benefits from being taxed and offers tax breaks for retirement income, further stretching retirees' budgets.

Louisiana:

In Louisiana, the state's median home price is below the national average, making homeownership more accessible for retirees. Louisiana also does not tax Social Security benefits and provides tax exemptions for retirement income, helping retirees keep more of their savings.

Alabama:

Alabama offers affordable housing options, with median home prices well below the national average. Social Security benefits are exempt from state taxation and the state provides tax breaks for retirement income, allowing retirees to stretch their savings further.

West Virginia:

West Virginia rounds out the list of the most affordable states for retired seniors, with a median home price below the national average. West Virginia does not tax Social Security benefits and provides some tax exemptions for retirement income.

Choosing where to retire is a significant decision that can impact an individual's financial security and quality of life. Our list of most affordable states for retirement offers a combination of low cost of living, affordable housing options, and tax-friendly policies for retired seniors. These three factors allow retirees to stretch their savings further and enjoy a comfortable lifestyle without breaking the bank.

Positives & Downsides of Each State

However, we also know how much entertainment, weather and culture factor into enjoying retirement. So let’s explore the positives and potential downsides when it comes to living in the most cost-effective states.

Mississippi:

Positives: There are several advantages to retiring in Mississippi, including its proximity to the scenic Gulf Coast beaches, friendly Southern hospitality, and pleasant climate.

Downsides: Retiring in Mississippi includes a less diverse cultural scene, fewer job opportunities, and the risk of natural disasters such as hurricanes, tornadoes, and floods.

Arkansas:

Positives: Retiring in Arkansas provides friendly communities, a relaxed pace of life, and access to beautiful natural scenery including lakes and mountains.

Downsides: Compared to other states Arkansas has limited healthcare and cultural activities in rural areas, challenging weather conditions, and a predominantly rural landscape.

Louisiana:

Positives: Louisiana presents several benefits for retirees, including vibrant culture, delicious cuisine, and unique blend of French, Spanish, and Creole influences.

Downsides: Retirement in Louisiana poses the challenges of high humidity and hot summers, risks of natural disasters such as hurricanes and flooding, and limited access to healthcare providers and specialized medical care.

Alabama:

Positives: When considering retirement, Alabama stands out with its beautiful Gulf Coast beaches, outdoor recreational opportunities, and rich history.

Downsides: Retiring in Alabama includes extreme summer heat, limited access to healthcare, and fewer cultural offerings.

West Virginia:

Positives: For retirees, West Virginia boasts serene natural beauty, access to outdoor activities, and a slower-paced, relaxed lifestyle.

Downsides: Retiring in West Virginia has its drawbacks, such as snowy and icy winters that can be challenging for seniors with limited mobility, and restricted access to healthcare facilities.

Ultimately, the best state for retirement is one that aligns with an individual's preferences, lifestyle, and financial situation. With careful planning and research, retirees can find the perfect destination to enjoy a fulfilling and financially secure retirement.

Conclusion

Choosing the right state for retirement can have a lasting impact on your aging parent’s financial security, well-being, and overall quality of life. By focusing on key affordability factors—such as low housing costs, healthcare expenses, and tax-friendly policies—you can help ensure their retirement savings go further. States like Mississippi, Arkansas, Louisiana, Alabama, and West Virginia offer not only a lower cost of living but also opportunities for a relaxed, enriching lifestyle.

As you support your loved one in this next chapter, remember that the best states to retire aren’t just affordable—they also align with their personal needs, preferences, and lifestyle goals. With thoughtful planning, you can help them enjoy a retirement that’s not only cost-effective but also full of comfort, connection, and peace of mind.

Find Retirement Living Services on Senior Care Finder

For elderly individuals, it is important to have the resources to find effective senior care services and senior living centers. Senior Care Finder is committed to providing all the best resources by offering a wide range of resources in our directory. Explore our Services page to begin your search to find sustainable and affordable solutions for senior living.